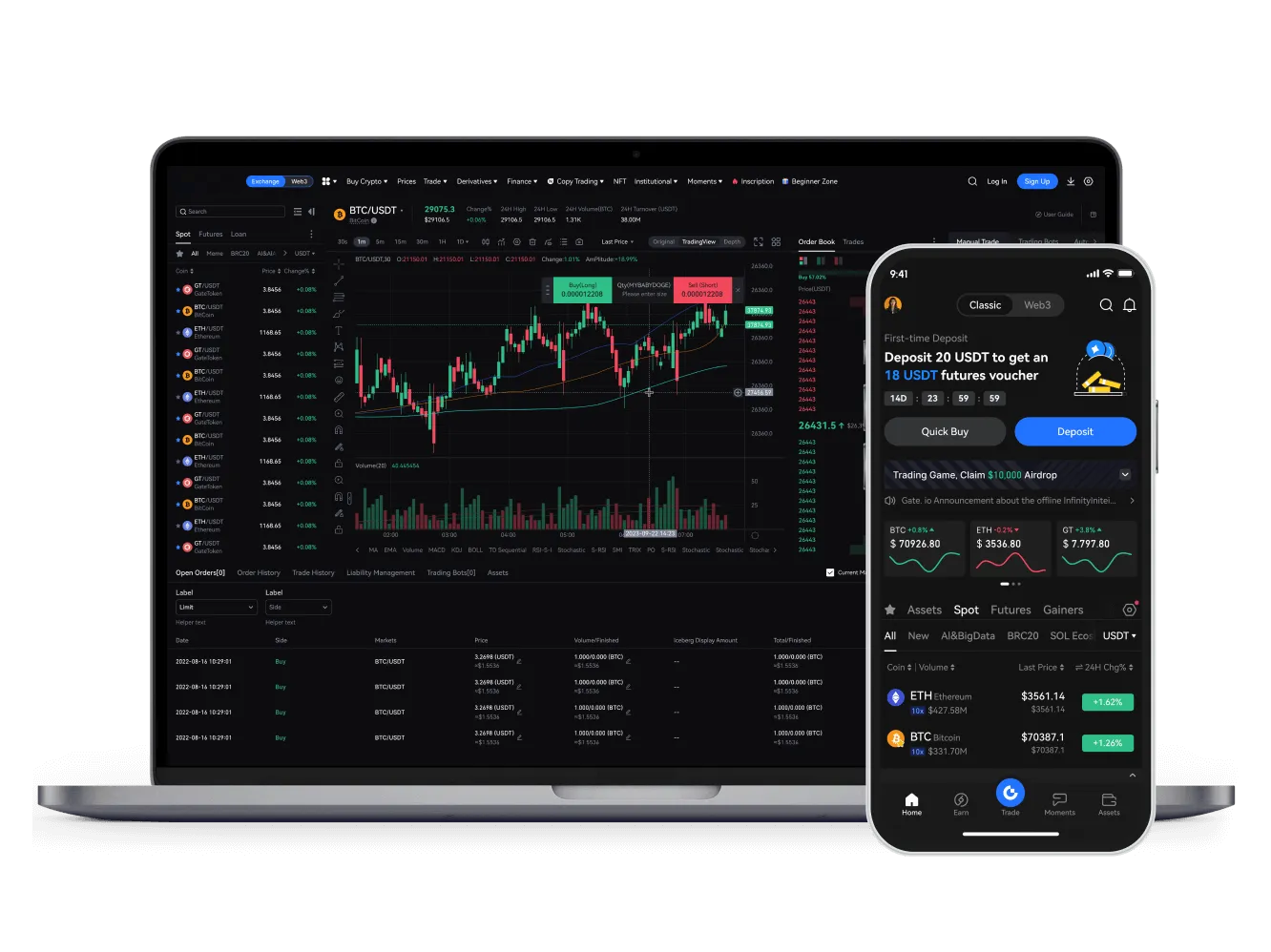

Connecting Global Liquidity with Institutional-Grade Execution

AETHEREX is a next-generation cryptocurrency broker and exchange platform, designed for professional traders and institutions. We provide deep liquidity access, ultra-low latency order matching, and transparent pricing under strict compliance and security standards.